Unpacking the Pump.fun Profit Puzzle: A Dune Analytics Deep Dive

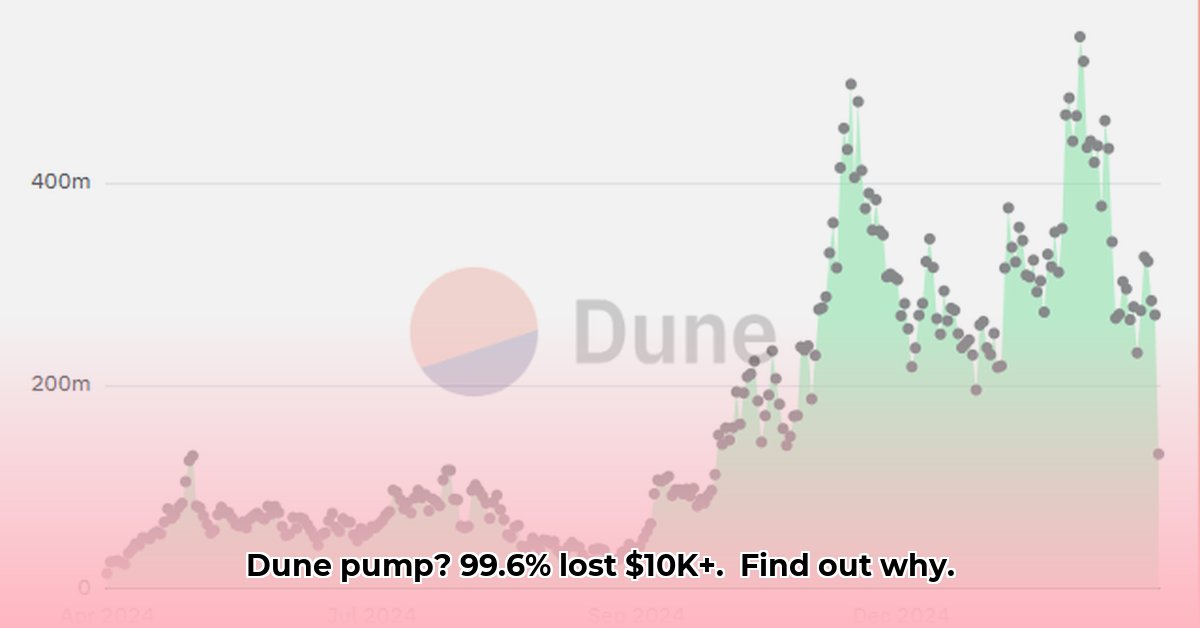

The decentralized finance (DeFi) space, while promising, often presents a complex picture of profitability. A recent Dune Analytics report on Pump.fun, a Solana-based memecoin platform, reveals a striking disparity: while the platform boasts nearly $400 million in total revenue (in SOL), a staggering 99.6% of users haven't realized profits exceeding $10,000. This raises crucial questions about the platform's dynamics, the challenges of DeFi profit measurement, and potential implications for investors, developers, and regulators. For more in-depth analysis, see this Pump.fun data analysis.

The Data's Limitations: A Nuanced Perspective

The Dune Analytics data, while informative, presents a potentially skewed view. The analysis focuses solely on realized profits—the actual funds withdrawn by users—excluding unrealized gains (profits on paper, yet uncashed). Transactions occurring outside Pump.fun, such as those on Raydium, another decentralized exchange, are also unaccounted for. This suggests the reported 99.6% figure likely overestimates the proportion of unprofitable traders. How much higher is this figure? Further research is needed. Why is there so much focus on realized gains? Don't unrealized gains still matter?

Profit Concentration: Early Adopters and Strategic Advantage

The significant gap between Pump.fun's overall revenue and the minuscule number of high-profit users suggests a concentration of wealth among a select group. This trend mirrors broader dynamics within the volatile DeFi ecosystem, where early adoption and sophisticated trading strategies often determine success. This uneven distribution of wealth underscores the importance of timing and market knowledge in navigating the risks inherent in this space.

DeFi's Transparency Challenge: Measuring Profit in a Decentralized World

Accurately measuring profit in DeFi is inherently challenging. Unlike traditional financial markets, DeFi lacks a centralized authority tracking transactions comprehensively. Analyzing on-chain data mandates both expertise and careful interpretation. Determining user profitability requires considering various factors, including the acquisition price of tokens (e.g., during an ICO versus open market purchase), transactions across multiple platforms, and considerations for gas fees.

Actionable Intelligence: Strategies for Stakeholders

The Pump.fun data provides valuable insights for diverse stakeholders. Effective strategies for maximizing profits should be developed.

Pump.fun Developers: Enhance data transparency to provide users with more comprehensive profit/loss tracking tools. Integrate with other DeFi platforms and create educational materials explaining risk and strategies.

Traders: Diversify investment portfolios, avoiding overreliance on single platforms or assets. Employ robust risk management techniques.

Regulators: Monitor DeFi platforms for fraudulent activities and develop regulations aimed at enhancing transparency and protecting users.

Researchers: Conduct further research, incorporating multiple data sources (like Raydium transaction data), to refine profitability models and improve data interpretation.

Calculating Pump.fun Profits: A Methodological Approach

Accurately assessing investor returns requires a multi-step process:

Realized Gains: Document profits from direct Pump.fun token sales.

Unrealized Gains: Estimate the current market value of held tokens, subtracting the initial investment. Remember, this is highly speculative.

Raydium Transactions: Meticulously record all Raydium trades, calculating individual profits or losses.

Total Profit: Add realized gains, estimated unrealized gains, and Raydium transaction results.

Risk Assessment: While this provides a more complete picture, memecoin market volatility and unforeseen events present inherent risks.

The Future of DeFi Profitability Analysis: A Path Forward

To gain a complete understanding of Pump.fun's profitability, future research must incorporate multiple data sources to create a more holistic view. The incorporation of unrealized gains, Raydium transaction data, and additional risk factors into future models is crucial for a more accurate assessment. A move towards more open data will be required to support this. This enhanced data analysis will prove to be important. The long-term viability of platforms like Pump.fun, and the broader DeFi ecosystem, hinges on robust transparency and accountability—a necessity for fostering trust and sustainable growth.